News:

Recently, Bedrock Capital and China Securities Journal launched a series of activities of "Exploring Value, Investing in the Future_Research Bank of Listed Companies in Guangdong, Hong Kong and Macao". The series lasted for one month, and the fourth stop was Shengyi Technology (600183) Group, a core supplier of high-end electronic materials such as copper clad laminate, prepreg and printed circuit board.

Fan Bo, vice president of Bedrock Capital, said that with the broad development of terminal applications in the 5G era, on the demand side, the demand for medium and high-end CCL/PCB has risen sharply, thus meeting the high-frequency and high-speed communication demand; on the supply side, domestic leading manufacturers layout medium and high-end CCL field, existing products have entered the echelon, speeding up the domestic replacement process.

PCB industry capacity shifts eastward

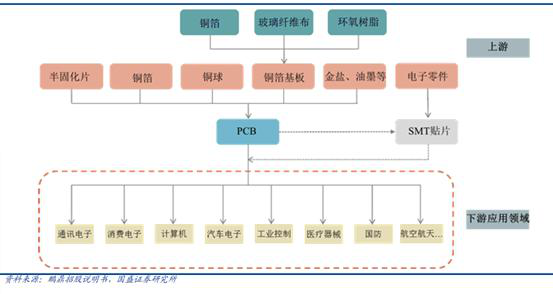

Copper Clad Laminate (CCL) is the upstream core material of printed circuit board (PCB), accounting for about 35% of PCB cost, and is in the middle of the entire PCB industry chain. The downstream industry is printed circuit board, and the terminal industry is downstream complete equipment such as communication, computer, home appliance, automobile, aerospace, etc. As the output value of the downstream PCB industry continues to rise, the copper clad laminate industry has also risen.

PCB is known as the "mother of electronic products", refers to the general substrate according to the predetermined design to form a point-to-point connection and printed components of the printed board, its main function is to make various electronic parts form a predetermined circuit connection, play a relay transmission role.

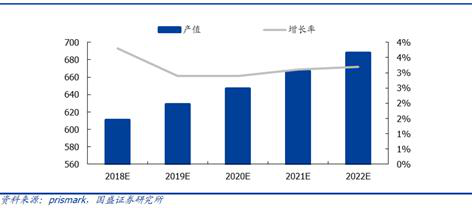

Data show that the global PCB output value in 2017 was 58.8 billion US dollars, a year-on-year growth rate of 8.55%. According to Prismark forecast, the global PCB market will maintain moderate growth in the next five years, Internet of Things, automotive electronics, industry 4.0, cloud servers, storage devices, etc. will become a new direction to drive PCB demand growth, and it is estimated that by 2022, the global PCB industry output value will reach 68.81 billion US dollars.

Table 1. Forecast of global PCB industry output value from 2018 to 2022 (unit: billion US dollars)

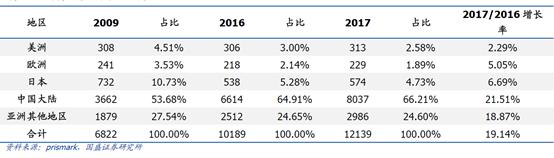

In recent years, the PCB industry has been moving eastward, and the status of China's PCB industry has been continuously improved. On the one hand, in terms of regional distribution, according to Prismark statistics, the proportion of China's PCB output value in global PCB output value increased from 35% in 2008 to 51% in 2017, with an average annual compound growth rate of 9%. In 2017, China's output value increased by about 10% year-on-year, surpassing the overall growth rate of global PCB output value. According to JMS's forecast, the global copper clad laminate output value will increase by 10% in 2020 compared with 2016, while China will increase by 21.8%; On the other hand, the mainland region has benefited deeply from the growth of rigid copper clad laminate. The output value of rigid copper clad laminate in the mainland of China has increased from 53.6% in 2009 to 66.21% in 2017. The output value of other regions except Chinese mainland has decreased. It can be seen that copper clad laminate also conforms to the trend of PCB industry moving eastward and is shifting to Asia, especially China.

Table 2. Distribution of global CCL output (millions of US dollars)

Domestic industry leader breaks through technical barriers

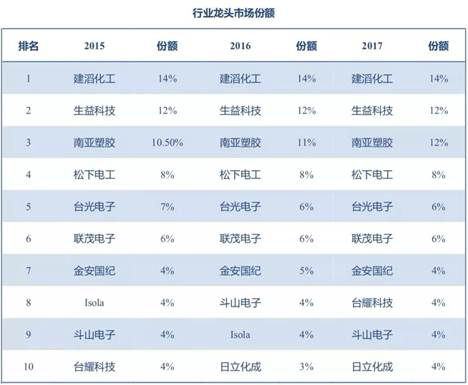

Due to capital and process barriers, CCL enterprises are relatively large in scale and stable in industry pattern. From the perspective of global ranking and market share, the total share of the top ten manufacturers in the global industry is 70%, and the ranking of manufacturers has changed little in recent years.

Fan Bo, vice president of bedrock capital, said that the construction of a complete production line requires manufacturers to have strong financial strength. Taking the important production equipment press for producing copper clad laminate as an example, the price of a press is more than 12 million yuan. The manufacturing process of copper clad laminate includes glue mixing, gluing, cutting, stacking, combination, hot pressing and other processes. Although different types of copper clad laminate share some basic processes, products with high technical stability need to be based on raw material materials, precision, structure, Other special requirements specified by customers to determine different production processes, manufacturers need to have a higher technical level to complete the production of high-tech products.

Table 3. Market share of industry leaders

Although the status of China's PCB industry continues to improve, the mid-to-high-end copper clad laminate is still dominated by overseas. According to the import and export data of CCL in mainland China in 2018, the export volume of CCL still exceeds the import volume, but the total export volume is lower than the total import volume, and the overall import price is still more than twice the export price. However, in recent years, domestic copper clad laminate leading enterprises such as science and technology, Zhongying Science and Technology, Taizhou Wangling, Huazheng New Material, etc. have made great breakthroughs in the field of high-frequency and high-speed materials. Some products can be compared with similar products such as Rogers, Panasonic, etc., which mainly focus on high frequency, filling the gap of domestic middle and high-end products.

Fan Bo gave an example. The step in the 5G era is to build base stations, which requires a large number of high-frequency high-speed substrates. At present, the suppliers used are domestic Shengyi Technology and Rogers abroad. Other manufacturers do not have this technology. Competitors who want to enter the market also need one to two years due to certification. In the competition with Rogers, Shengyi Technology, as a local enterprise, has a shorter delivery time and a lower price advantage. Rogers 'delivery time is 4-6 weeks, while Shengyi Technology only takes 3-7 days. At the same time, Shengyi Technology is 20% lower than Rogers in cost. It can be said that domestic enterprises have already taken advantage of the competition of 5G high-frequency board.

High-frequency high-speed copper clad laminate will usher in high growth

With the broad development of terminal applications in the 5G era, on the one hand, the three major operators will begin to carry out the pre-commercial phase of 5G in 2019 and 2020. The investment and construction of base stations will be carried out intensively, and the demand for high-frequency and high-speed copper clad laminate (CCL) will rise sharply. Since the radio frequency used by 5G is much higher than that in the 4G period, and the higher the frequency, the greater the attenuation in the propagation medium. Therefore, if high frequency bands are used for mobile communication, then its big problem is that the transmission distance is greatly shortened. The coverage capability is greatly weakened, covering the same area, the number of 5G base stations required will greatly exceed 4G.

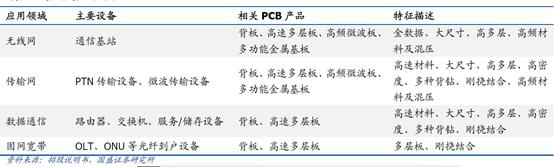

Table 4. PCBs used in various links in the communication field

On the other hand, driven by the demand for entertainment, safety and comfort, higher penetration rate of electronic equipment in new energy vehicles, automotive electronics and other applications has also led to the demand for upstream copper clad laminate/printed circuit board (PCB). According to the cost ratio data of automotive electronic devices of China Industrial Information Network, the average cost of electronic products has accounted for about 20% of the total vehicle cost, and the vehicle has reached 50% or even more than 60%, while the automobile electronic cost of pure electric vehicles has reached 65%.

Table 5. Upstream and downstream relationship of CCL industry

At present, the three companies with output value are all Chinese enterprises, namely Jiantao Chemical, Shengyi Technology and South Asia Plastics. The sum of the three companies accounts for about 37% of the total CCL market share, and the output value of the top 10 enterprises in the industry accounts for 74% of the total market share. The industry concentration is very high, and the high concentration gives birth to the bargaining power of the industry leader.

Fan Bo said that the leading enterprises have strong bargaining power, and when the upstream raw material price rises, they can usually transmit the cost pressure to the downstream PCB industry, increase the product price, and then increase the gross profit level, but the price transmission has a time lag, because PCB enterprises will have certain copper clad laminate inventory, and the price of PCB products may not be raised in time in the month when the copper clad laminate price rises, and will generally be adjusted accordingly in the following months. When the upstream raw material price reduction, the impact on the copper clad laminate industry is greater, because the downstream is a fully competitive market, there is no good hedging means, PCB manufacturers will follow up the price of copper clad laminate raw materials in a timely manner, requiring corresponding price concessions.

[scan the QR code]

[scan the QR code]